Alcohol Action Ireland press release, 3 September, 2024

Alcohol Action Ireland (AAI) notes with dismay the latest attempts by the alcohol industry to increase their shareholders’ profits at the expense of the public purse with their reckless call for a 15% decrease in excise duties – a move that would cost the exchequer close to €200 million a year.

Alcohol excise duties have not been changed in a decade and in that time their benefit value has been eroded by inflation. In its pre-budget 2025 submission, AAI is calling on government to increase excise duties on alcohol by at least 15% – a move that would bring them back to their 2014 level – and, going forward, that they be linked to the Consumer Price Index.

Shop-bought alcohol is around the same price today as it was 20 years ago, with the introduction of Minimum Unit Pricing in 2022 only bringing it back to 2003 levels. As of 2023 it is 70% more affordable than in 2003. Even alcohol bought in the on-trade is 14% more affordable than it was two decades ago.

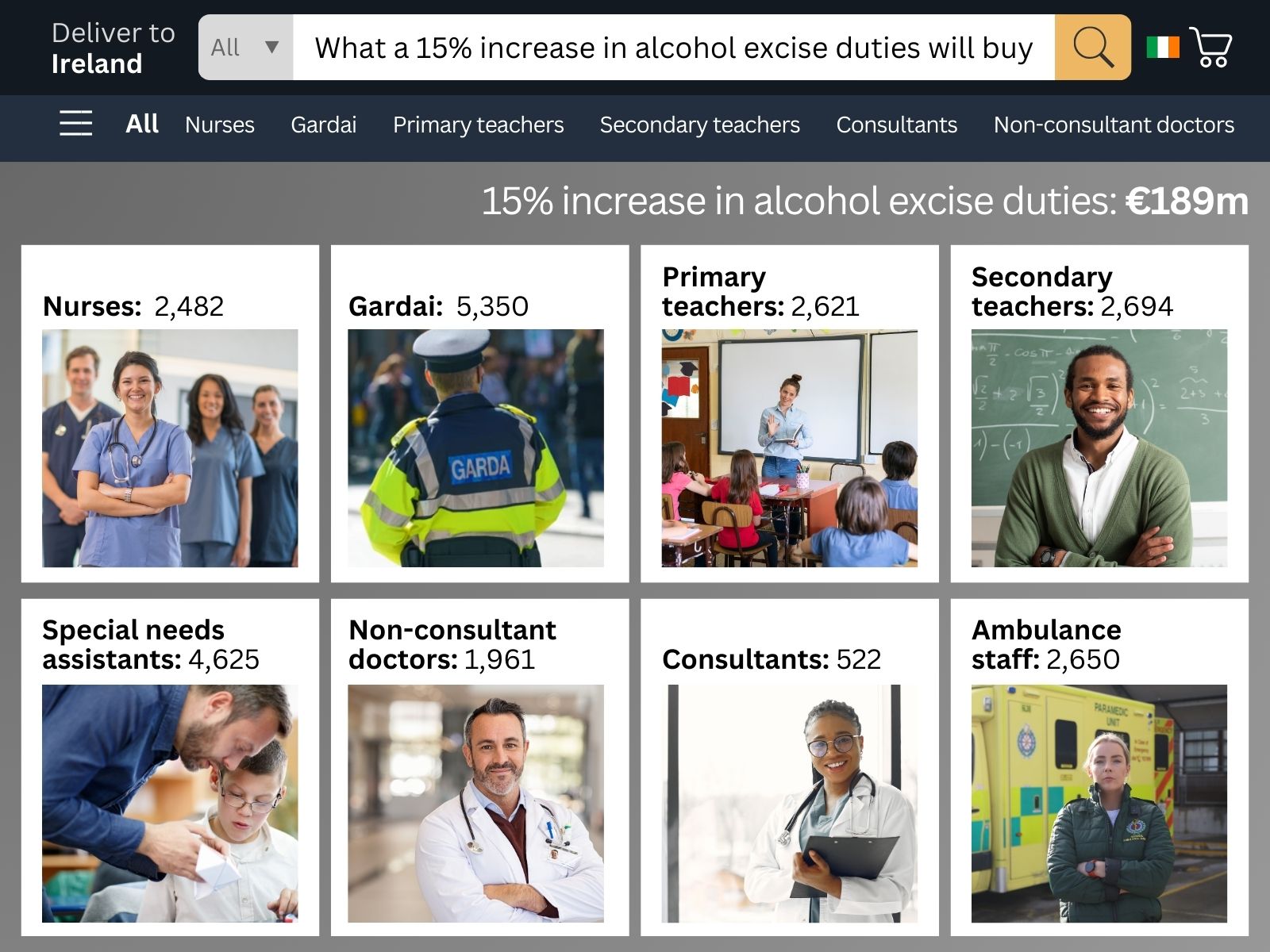

AAI CEO Dr Sheila Gilheany said: “A 15% increase in alcohol duties would equate to an extra €189million for the public purse, money that is badly needed to deal with the multiple harms caused by alcohol. €189million is enough to fund 2,480 nurses, 2,650 ambulance staff or 5,350 new gardai. The fact that the alcohol industry is looking to take an equivalent amount out of public use and give to their shareholders is reckless at a time when our public services are already stretched.”

Beyond alcohol duties there is also a need to consider other ways to ensure that the alcohol industry pays for the harm caused by its products. AAI is calling on government to:

- develop a new ‘polluter pays’ alcohol levy system, with funding raised to be ringfenced for alcohol harm reduction strategies

- introduce a mechanism for automatic uprating of Minimum Unit Pricing in line with inflation otherwise it will lose its public health value

- provide funding to the HSE to develop its own trauma-informed treatment services, as well as funding Alcohol Care Teams within all major hospitals

- provide dedicated funding to give the national Hidden Harm framework – that recognises the adverse childhood experience of growing up with parental problem substance use – momentum and urgency

- provide immediate top-up funding for youth mental health services and initiatives

Dr Gilheany continued: “Alcohol harm costs the state €12 billion every year and brings in only a tenth of that in excise duty – €1.2 billion. The use of excise duties to combat alcohol harm is recognised internationally as one of the WHO’s ‘Best Buys’ policy solutions, while national and international expert groups including the Commission on Taxation and Welfare, the OECD, the International Monetary Fund, and the World Bank have pointed to the powerful role that alcohol taxation can have in reducing the public health burden from alcohol and the need for this to be linked to inflation in order to maintain its public health value.

“There are 1,500 hospital beds in use tonight due to harm from alcohol, Ireland’s cheapest and most widely available drug. The harm from alcohol permeates all areas of society and places a huge burden on government finances – from the justice system through health, workplace productivity and children and family impacts.

“As well as doctors and nurses, the 15% increase that AAI is calling for would be enough to fund nearly 2,700 teachers, more than 4,600 Special Needs Assistants or more than 520 consultants. Government must ensure it puts public health before the private wealth of the alcohol industry and increases excise duties on alcohol.”

END

NOTES

- AAI pre-Budget submission can be accessed at:

https://alcoholireland.ie/wp-content/uploads/2024/05/Pre-Budget-2025-Submission.pdf - Analysis of changes in alcohol prices, taxation and affordability in the Republic of Ireland. Sheffield University Report.

- Alcohol excise duties in 2023 raised €1.2 billion. General Excise Tax Strategy Group, July 2024. 15% rise across all alcohol excise duties equates to €189 million.

- Data re comparison of alcohol affordability levels across OECD countries available at: Preventing Harmful Alcohol Use. OECD 2021

- Links to reports cited available at: Commission on Taxation and Welfare, the International Monetary Fund, World Bank, World Health Organisation

- Costing for nurses, ambulance staff, gardai, teachers, Special Needs Assistants, consultants

- AAI’s media language guide can be accessed here